Yet it's the loan provider that eventually determines what the minimum credit rating will certainly be for every lending product. A home mortgage with poor credit rating is feasible, also if you're a new house buyer. These low credit score mortgage lenders focus on serving consumers with credit report difficulties.

Our acclaimed lending contrast solution sees to it you get our best interest prices. Our aim is to offer you with one of the most updated information, as well as useful devices and also calculators to assist you make life's crucial decisions and also take control of your cash. Guarantor mortgages permit having a hard time customers to protect their residence by having parents, close family members or friends tackle some of the danger. Right here's whatever you require to find out about guarantor home loans, consisting of the advantages and disadvantages of this type of home loan as well as exactly how to obtain a bargain.

- Navy Federal membership is restricted to professionals, solution participants, as well as others with close affiliations with the armed force.

- All is not shed, nonetheless, since expert poor credit scores home mortgage brokers like Believe Plutus can aid.

- This demonstrates you are making an investment in the house and have "skin in the game," improving the chances that you will remain present on the finance.

- We specialise in assisting clients that have negative credit history signed up such as CCJ's, defaults, missed out on payments and also home loan defaults.

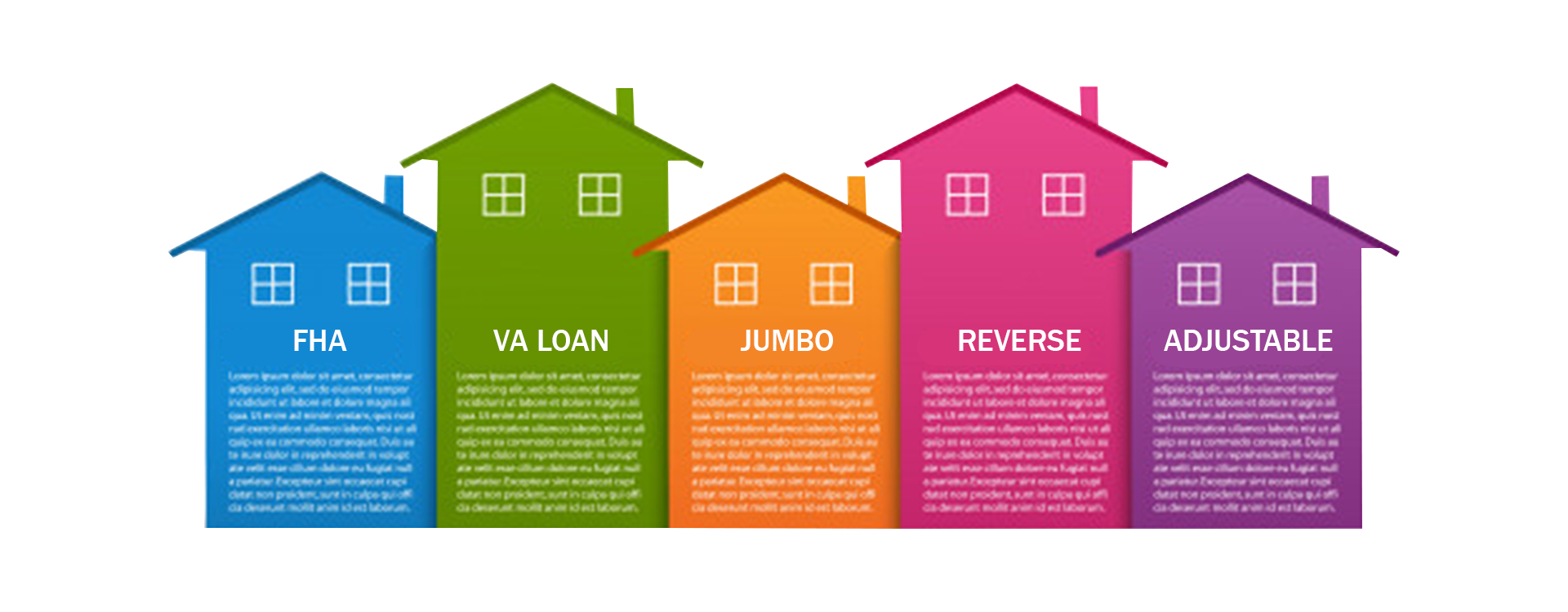

- FHA Car loans are released by private lenders however backed by the Federal Housing Administration.

When considering your home loan application, lenders often tend to look not just at your credit scores score, yet the details of your credit rating. The loan provider will wish to know what took place, when, as well as the circumstances. A missed utility costs will be evaluated in different ways from a Region Court Judgement, for example. Below are the very best rates available on bad credit report home mortgages for individuals who are relocating residence (i.e. non-first-time purchasers). We haven't consisted of the prominent financial institutions as they do not use any mortgages particularly for people with negative credit history.

Some individuals who obtain home loans with a greater interest rate do so with the objective of switching over to a more affordable handle the future with a remortgage, once their credit report and also record has actually boosted. Bad Debt or adverse credit history, comes in all sizes and shapes, from missedKlarnaor credit card settlements to personal bankruptcy. By comparing to us you could conserve cash on anything ranging from credit cards as well as lendings, to interest-bearing accounts, spending as well as insurance coverage. You'll additionally locate the support you require to make enlightened economic decisions. A subprime home loan is simply one more name for a negative credit rating mortgage, which is designed for those with bad credit report ratings.

Can I Obtain A Home Loan With A Low Credit History?

Actually, several of the greatest loan providers out there want to aid consumers with credit scores near or below 600. Stopping working to make payments in a timely manner-- either on expenses or on outstanding debts-- can be taped as a default on your credit history. A range of remortgaging deals https://troyqypk328.wordpress.com/2022/08/13/best-home-loan-loan-providers/ are readily available on the high street, with Great post to read rates similar to those in the home moving companies tables above, so it deserves searching.

Bankrate adheres to a stringent content plan, so you can trust that our web content is truthful and also exact. Our acclaimed editors as well as reporters produce straightforward and also precise content to help you make the best financial choices. The content produced by our editorial team is objective, accurate, and not influenced by our marketers. Bankrate adheres to a stringent editorial plan, so you can trust that we're placing your passions initially. Bankrate has partnerships with companies consisting of, however not limited to, American Express, Bank of America, Resources One, Chase, Citi as well as Discover. Christy Bieber is a permanent personal finance and also legal writer with greater than a years of experience.

A specialist mortgage broker can utilize their network to search for niche lenders. If you have major credit score problems like current council financial obligation, a CCJ or bankruptcy, you might locate it challenging to discover a lending institution. A longer-term time may make your repayments extra manageable as they're topped a longer amount of time but you'll probably pay even more in interest generally, making the mortgage extra expensive. A consumer with negative credit score may be expected to give a bigger chunk of the residential or commercial property's worth upfront but that's not to say that bigger financings can not be accessed with bad credit score. This definitely isn't a one dimension fits all policy, given that there are so many various other factors that influence the maximum quantity you can obtain, so for recommendations based upon your scenario, ask a home loan broker.

Can I Obtain A Bank Loan If I Have Poor Credit Score?

Stop billing charge card and also refrain from opening up any new credit accounts before you request your home mortgage, as well as throughout the application process. The majority of lenders need a rating of at least 580, and also some lenders' minimums are also greater. Often creditors want to get rid of a late settlement from your credit rating report if you've mostly been an excellent client. The size of your credit report is a vital consider identifying your credit history. While you can get a mortgage with negative credit, your home mortgage will be cheaper as well as you'll have a wider option of lenders if you raise your score. There are seven simple actions you can require to help you rebuild debt.

That isn't to say it's impossible to get a wonderful loan-to-value with these issues against your name, but specialist guidance will certainly be crucial. Likewise, rate of interest for customers who have had a property repossessed within the last three years have a tendency to be really high, however they should continuously decrease with every passing year. The longer the customer handles to keep financial task without event, the reduced the danger of loaning. Obtain an OMA ® Home mortgage Record today to access your likely price, prices and listing of lenders readily available to you. Whatever your circumstance, at OnlineMortgageAdvisor we know that everyone's scenarios are different. That's why we just deal Learn more with specialist brokers who have a tested performance history in safeguarding mortgage approvals.

You can check your credit report free of cost through any kind of as well as all of the debt reference agencies, each of which have on-line websites that make it a quick as well as simple procedure. It is worth registering with all three because they have such different methods of analyzing your credit report. Sign up for month-to-month updates on your rating also, if these are readily available, so you are made aware of any adjustments, excellent or negative, in good time. Anything much less than this and also you might battle to be approved for a. mortgage and require to check out loan providers who supply people negative credit scores home loans. The majority of specialist negative credit history loan providers will only accept applications made through a trusted intermediary like a mortgage broker anyhow.